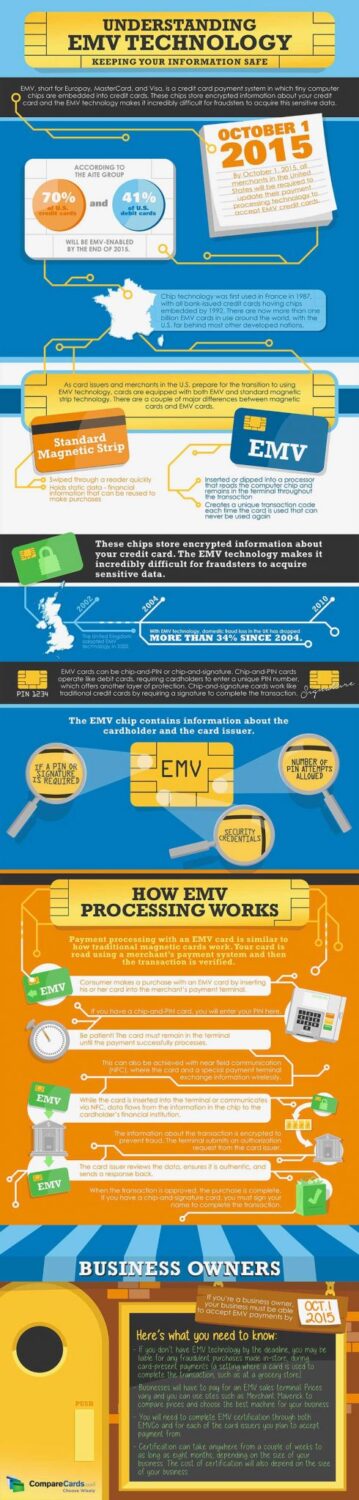

EMV (Europay Mastercard Visa) is a set of standards for acceptance and producing of payment cards with chip.

The world is currently in the course of large-scale campaign to introduce EMV technology in electronic payments and the final withdrawal of obsolete magnetic card. Unfortunately, the estimated time for completion of these actions is estimated at several years and is constantly increasing. The reason is, of course, of an financial nature – namely, in the world there are currently millions of ATMs and POS that do not support chip cards, some of them can be adjusted (upgraded), while large amount can only be replaced by new ones, which is great financial burden for owners of these devices.. The biggest problem is America, where the card business developed earliest and where the market has become cluttered with the EFT (Electronic Fund Transfer) terminals much before the any chip technology was contemplated.

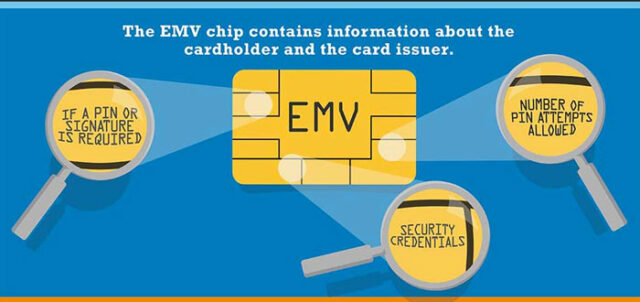

EMV cards are finally put into practice and the rest is only a matter of time before they become liabilities. Advantages of EMV are obvious and relate mainly to the functionality provided by the chip. Unlike the static structure of magnetic stripes that allows only record and read data, the chip contains a microprocessor with its operating system and the entire set of commands that can be executed. File system-on-chip controls who and under what conditions can access the contents in memory. What is very important is that the safe operation of the keys is supported. This means that the keys, as loaded into a protected memory (loaded in pure form or encrypted transport key), can no longer be accessed directly, but only indirectly through cryptographic functions performed by the microprocessor card. Multiplicativity of chip is very significant. In EMV technology each application represents one type of card, with all the necessary data and keys. So it is possible that on one card can be more applications (different payment systems). Below you can check infographic about more informations about EMV technology: