Employee earnings records are not only a legal obligation – but they are also a valuable source of information about one of the most important resources of any company. Earnings calculation is one of the most complex items within your business – and contains very complex calculations.

For this reason, most companies use specialized paystub software. Due to frequent changes and the need to always make the process of calculating salaries on time – such software and applications have a special significance – and you need to master their use. Therefore, here are 3 key tips for creating professional pay stubs for your employees.

How Can We Use Pay Stubs Software And Apps?

Nowadays, paystub software is in widespread use. It is primarily intended for the calculation of personal income for an unlimited number of workers – who work in production, directing, or combined. These programs are adjusted not only to the needs of the company – but also to the latest regulations on earnings and are constantly adjusted to their changes.

Thanks to a large number of adjustable parameters – each user can easily use the paystub generator and adjust the program according to their method of calculating earnings. The data is entered from the report – where the program calculates the earnings itself. The program can and does calculate credits and suspensions for workers who have them. All contributions, sick leave, as well as various benefits are automatically calculated.

Generating Pay Stubs By Using Online Tools

You will admit that the administrative work related to the calculation of salaries, taxes, working-hours, or payroll – is often long, arduous, and above all tedious job. Moreover, in many countries, this calculation includes insurance – which is an additional job. Besides you have to take care not to make a mistake somewhere – this also requires a lot of time and affects productivity within your company. Fortunately, the good thing is that you are able to do this more easily with the help of a paystub generator.

Moreover, today on the Internet you have the option to use a free paystub generator – or download a free pay stub template. That way, your job will be much easier. You will no longer have to wonder how to make pay stubs. Simply log in to the network – and use tools like a free check stub maker with a calculator. Everything will be much easier and more efficient.

How To Create Pay Stubs For Your Employees – Major Tips

In today’s era of the Internet and online software, this job is easier than ever before. Here are the main tips to follow when you want to create pay stubs for your employees.

1. Be Thorough When Entering Data

To do pay stubs properly and well – you need to be thorough and detail-oriented. This means that you must enter all information and data accurately and precisely. So, this kind of work requires precision from you, not a lump sum assessment. This means that you cannot enter the amounts approximately, or round the figure – but it must be precise. For example, if your employee’s weekly salary is $ 1,195, you cannot write $ 1,200.

You must enter the exact amount for payment. According to paystubsnow, there are also other significant details that you must enter carefully and precisely – such as the names and addresses, the date as well as the number of working hours, etc.

2. Precise Calculation And Creation In Appropriate Form

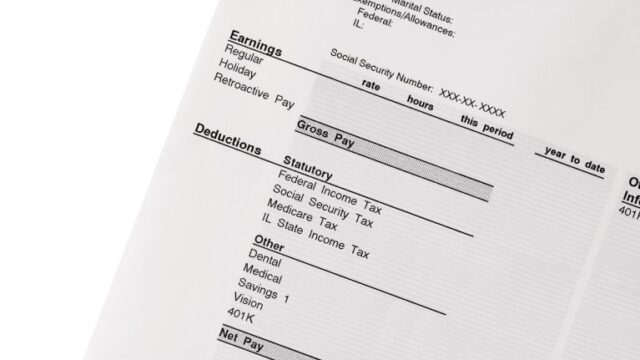

Pay stubs must be made according to a certain principle. Therefore, certain rules must be followed – as well as the form when creating it. What exactly does that mean? Pay stubs must clearly show all the financial deductions or taxes that the employer will exempt from the check. Using a paycheck stub maker will make it much easier for you to manage in a bunch of things you would otherwise have to think about – like Social Security, Medicare, or the Federal Insurance Contributions Act (FICA). With the help of modern online programs, you will be able to calculate the net earnings of your employees much easier.

Also, a very important element is the formatting – that is, the appearance of the pay stubs you create. They must have a certain precise form and must look professional. If you don’t know how to create such a look yourself – you can use a free pay stub template. Keep in mind that the online offer of these templates is wide.

3. Usage Of Professional Tools

The best solution you can opt for to make your job easier and thus be more efficient and productive – is to use online tools like the paystub generator or cloud-based payroll software like uzio.

Why would you waste your precious time typing, formatting, calculating, and making deductions? All this can be managed using the modern software made especially for this purpose. After entering the data, the online paystub generator will only need a few seconds to do a job that would cost you a lot of time.

Creating Pay Stubs Is Significant For Both – Employees And Employers

If you are an owner of a small company, and you have to process the earnings of your employees manually – it might be a hard job that will take you a lot of time. Also, it means that you have to be a good and skillful accountant and you must know the financial regulations in your country to calculate everything correctly. All of this sounds like an almost impossible mission – so you must include creating pay stubs in your business. This is useful for both you and your employees because this way you can easily keep track of important financial information – such as deductions, taxes, etc.

Certainly, such online tools help employers keep records of salaries. It is up to you to decide whether to opt for some paid software – or to use one of the free or demo versions that you can find online. Of course, you will make this decision based on your real needs – but keep in mind that even small businesses lose productivity when processing salary data manually. Therefore, it is recommended to use an online paystub generator that will make your job faster, more efficient, and more accurate.