Ah, summer. The sun comes out, the temperature warms up and America heads outdoors. Insurance is the last thing most people want to think about but if you’re a homeowner, you should. For two reasons.

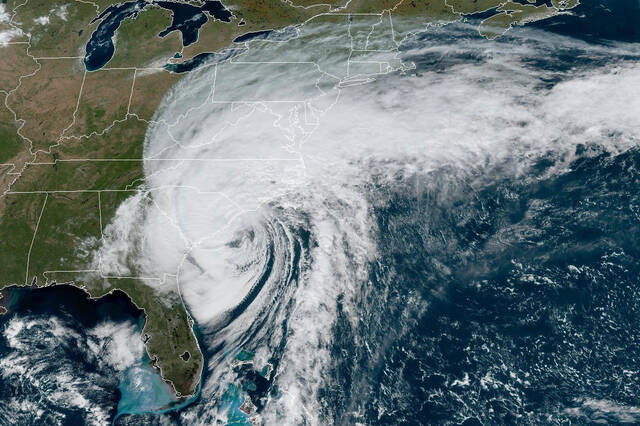

First, our summers are on the frontlines of extreme weather patterns. Massive columns of thunderstorms that run the entire length of the country from North to South bring wind, hail, torrential rain and even spawn tornadoes. According to the Triple I (Insurance Information Institute), the majority of home insurance claims in 2020 were for wind and hail damage (45%) followed by fire and lightning damage (23.8%). All you have to do is watch the evening news to see the widespread devastation these storms leave in their wake.

Unfortunately, the frequency of such disasters has increased dramatically over recent years, forcing major insurance companies to rework their policies and premiums. Those that continue to serve higher-risk geographies have raised their rates; often by 800% or more. Meanwhile, the payouts from claims may not take into account the ballooning cost of reconstruction and repair work. Building materials prices are up 19.2% year over year and have risen 35.6% since the start of the pandemic. The average homeowners policy contains $250,000 in coverage. For many, that may not be nearly enough to cover the cost of repairing or rebuilding a severely damaged home. It’s important to periodically update your policy to make sure that if the unexpected happens, you won’t need to come up with the delta between coverage and costs.

“It’s also important to review your homeowners policy if the value of your house has gone up due to either rising real estate values or if you’ve made any significant home improvements,” says Craig Eagleson, President of Incenter Insurance Solutions. “Such changes may also merit an increase in coverage.”

Another reason to take a close look at your policy is liability. Although liability claims account for less than 4% of total homeowners insurance claims, the payouts tend to be higher.

Most homeowners understand the basic concept behind liability insurance is to provide coverage in case you’re sued by someone injured on your property. However, the coverage amount should be reviewed, and if necessary, adjusted based on a number of variables. For example, if you have added a dog to the family, put in an inground or above ground pool or installed anything else that may increase the chance of an accident on your property (think trampoline), then it’s time to consider broadening your coverage.

Summer is a good time to take an honest look at things like your front steps. Are they in good condition? Is the railing solid? Most homeowners associate ‘slip and falls’ with winter ice and snow, but they happen during the summer, too. Something as simple as uneven bricks on a walkway can send someone tumbling and reaching for a personal injury lawyer’s phone number. Get those repairs done while the weather is nice!

Of course, these are just basic guidelines for ensuring your home and financial stability don’t become casualties of the summer months. Since every home is different, and every insurance policy varies, it’s always a good idea to consult with an independent insurance agent. They can tell you whether or not your coverage is adequate or if it falls short.