Many people would say that the arrival of the Bitcoin and Electronic money has marked the beginning of a technology centered economic revolution. Like any major breakthrough projects, these are also frowned upon and hidden behind a veil of skepticism, but the fact is more merchants are accepting this type of payment in exchange for their products or services, thus neglecting palpable currencies. With a slight intention of a dramatic effect, let’s say that this could irreversibly change our lives and social interactions.

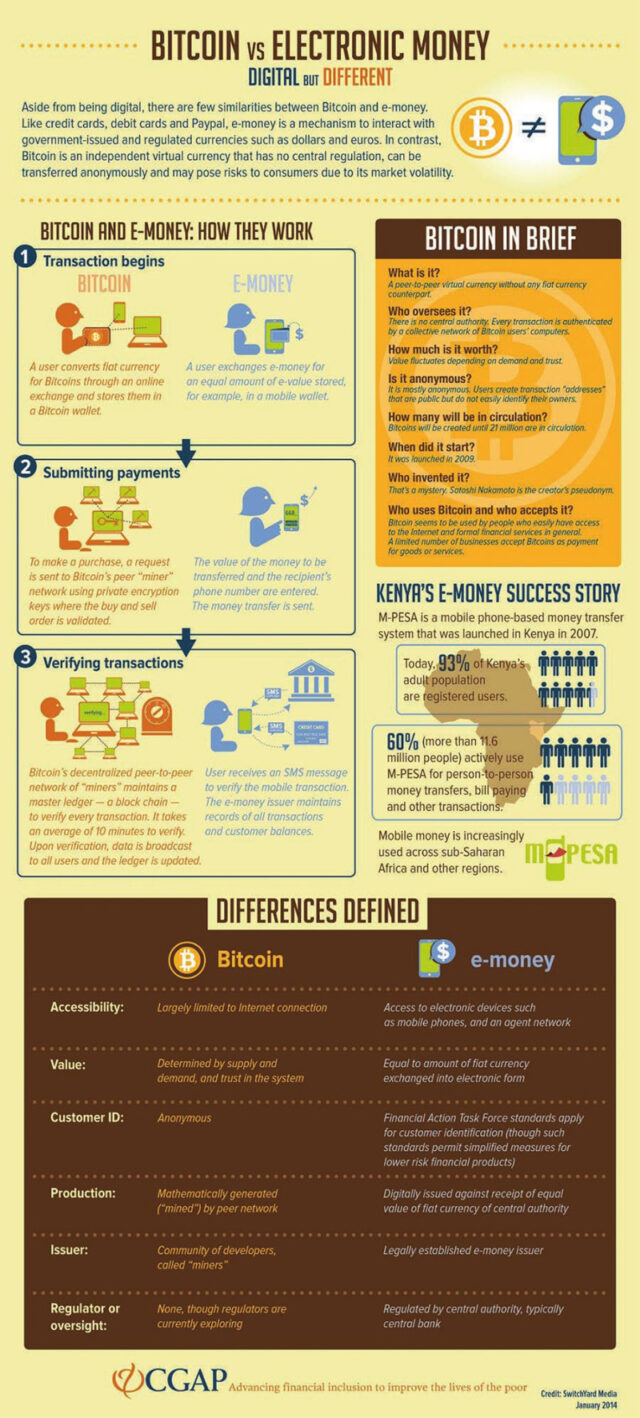

Besides both being digital, Bitcoin and e-money have little in common. While e-money is a system tied to the real and government-issued money designed to manage it virtually, Bitcoin is an independent cryptocurrency issued and controlled by its developers and users, with no possibility of reaching the real world in a form of a bill.

Bitcoin was launched in 2009 by a mysterious entity under a pseudonym, as a peer-to-peer transaction utensil located on the Internet, without any equivalent in the outside world. The whole point of the Bitcoin money is that there is no patron institution in charge of overseeing its circulation (like a central bank), but only a network of users who verify the total of mostly anonymous transactions. New Bitcoins are created by solving complicated mathematical problems whose solution represents the verification of an individual transaction. However, the total number of Bitcoins is meant to not exceed 21 million, and the sum is controlled every four years. Compared to the Bitcoin concept we have an example of M-PESA, a virtual transfer system also referred to as ‘mobile money’. M-PESA was launched in Africa in 2007 and reached outstanding 11.6 million users until now. In fact, 93% of the population of Kenya is a registered user of this quite simple way of sending or receiving money. It starts with converting fiat money into an equal e-balance. By only entering the recipient’s mobile number and the transferred amount you have concluded the transaction. Well, technically the transaction is concluded when you receive an SMS from the issuer authenticating it. It stands quite clear that the underlining benefit of this concept is eliminating the middle man aka banks. It is why the project has most success in poorly banked areas.

Now if we lay these out next to one another what are actual differences between Bitcoin and e-money? First of all, it has to be point out that Bitcoin is dependable on user’s Internet connection, while e-money allows you access through devices like mobile phones or an authorized agent network. The second aspect that differs is the value. Bitcoin’s value is determined by the supply and demand, whereas e-money has equal value as real money that has been exchanged into its virtual form. Another characteristic of the Bitcoin is that its users remain anonymous, cause their ‘addresses’ can’t be linked to their actual names or any other private information, which is not the case with e-money. The issuer of the currency in both cases is quite opposed – Bitcoin is being generated by a community of online developers, and e-money is issued by a legally established issuer, a certified financial institution. The same principle applies to the supervising and regulations. Bitcoin has no oversight beyond users themselves, and e-money is controlled by a central authority, normally a central bank. For more take a look at infographic below:

All of this electronic/virtual currency ordeal still sounds quite futuristic and revolves around questionable circumstances, so there is no way of knowing whether these projects will be successful on the long run. They have their ups and downs and it is always for the user to decide the handling of his earnings. The money makes the world go round, but does that apply to the virtual world too?