Investing for the first time can seem overwhelming, but it doesn’t have to be. Building wealth requires focus, patience, and the right approach. This guide explores strategies that can help you start strong and avoid common mistakes.

Key Points

- Learn the benefits of income-generating investments.

- Use economic indicators to identify profitable sectors.

- Focus on risk management and diversification.

- Understand how dividends support long-term growth.

- Explore tools that help evaluate potential investments.

1. Why Income-Generating Investments Matter

Investors often overlook the simplicity of earning passive income. Income-generating assets like dividend stocks offer consistent returns that can compound over time. They can also act as a safety net during volatile market periods. For those just getting started, they provide a clear path to building a solid financial foundation.

For example, you can explore top dividend stocks to find companies offering steady returns. Companies with a strong track record often continue rewarding investors, making them a valuable part of any portfolio.

2. Using Economic Indicators to Spot Opportunities

Economic indicators provide insights into potential market movements. Tracking data like interest rates, inflation, and GDP trends allows investors to align their strategies with prevailing conditions. A strong GDP growth rate, for instance, signals that businesses are thriving, which boosts investor confidence.

Key Indicators to Watch

- Interest Rates: Low rates often drive growth in dividend-paying sectors.

- Inflation Trends: Moderate inflation benefits equity investments.

- Consumer Spending: Increases suggest robust company revenues.

Understanding these signals can help you predict shifts in various sectors and identify profitable opportunities.

3. The Role of Diversification in Risk Management

Putting all your resources into one asset increases risk. Spreading investments across different sectors, regions, and asset classes can shield your portfolio during economic downturns. Diversification ensures that losses in one area won’t erase your entire progress.

For instance, combining real estate investments with dividend-paying stocks and bonds balances risk. Many professional investors recommend allocating funds to various industries to minimize exposure to one failing sector.

Three Practical Tips for Diversification

- Allocate 60% to equities, 20% to bonds, and 20% to cash reserves.

- Explore ETFs for low-cost, diversified exposure.

- Avoid relying too heavily on one investment type.

4. How to Analyze Dividend Stock Opportunities

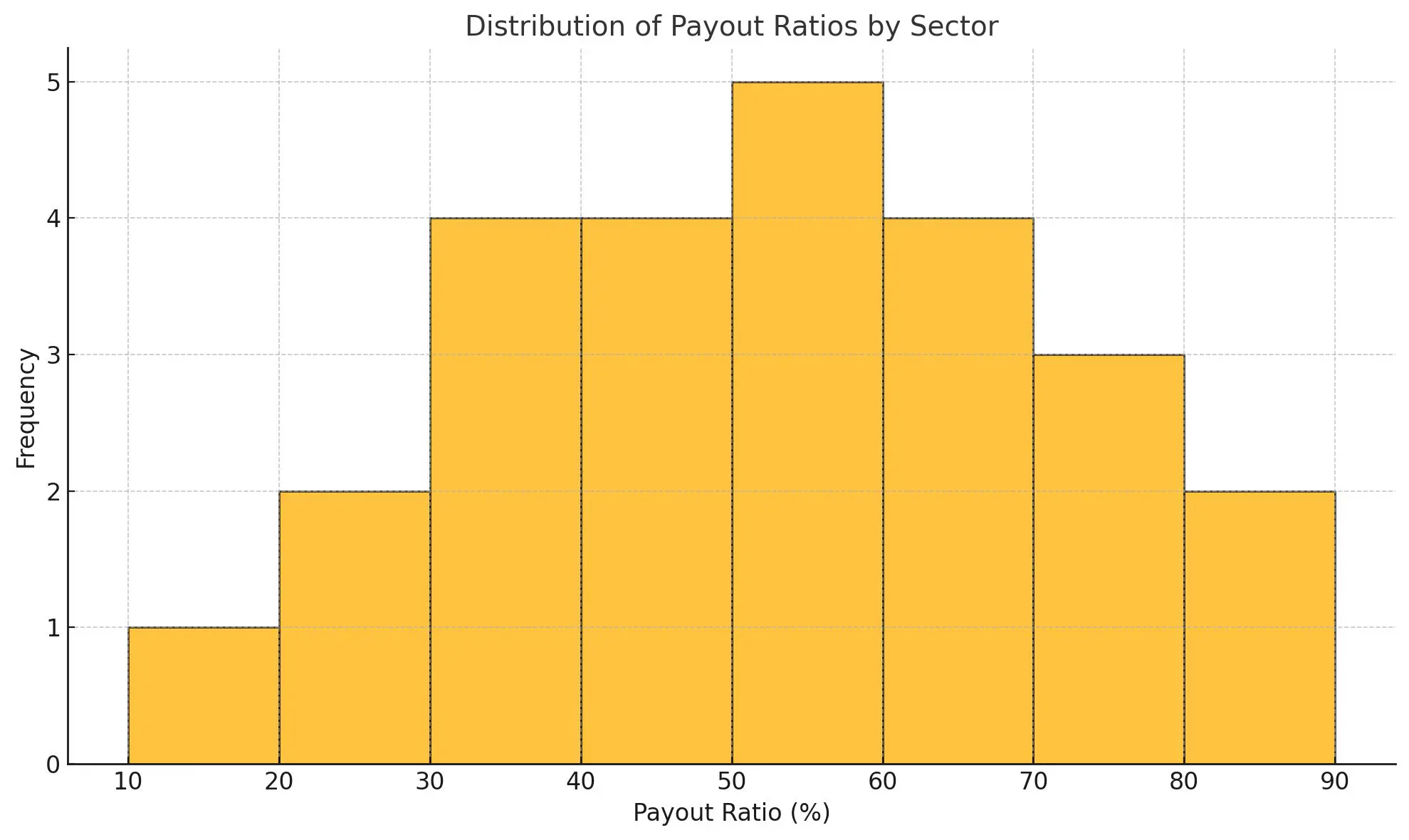

Choosing the right stocks requires careful analysis. Look for companies with sustainable payout ratios and consistent growth in their earnings. A payout ratio below 50% suggests that the company retains enough capital to reinvest while sharing profits with investors.

A Simple Checklist

- Earnings Growth: Companies with stable revenue increases tend to pay consistent dividends.

- Low Debt Levels: High leverage can lead to reduced payouts during financial stress.

- Payout History: A strong record indicates reliable returns.

Here is the histogram showing the distribution of payout ratios across different sectors:

Each bar represents the frequency of payout ratios within specified intervals, providing a clear view of how sectors compare in terms of dividend payout tendencies.

5. Tools That Simplify Decision-Making

Modern tools make investment research easier. Apps and platforms provide real-time updates, stock analysis, and personalized recommendations tailored to your financial goals.

Top Tools to Consider

- TradingView: Analyze charts and trends for informed decisions.

- Morningstar: Access in-depth company reports.

- Yahoo Finance: Monitor global markets in real time.

Choosing the right tools depends on your goals. Many beginner-friendly platforms include free tutorials to guide you through their features.

6. Avoiding Common Pitfalls

Jumping into investments without a clear plan leads to mistakes. Many new investors focus on quick gains, ignoring the value of steady growth.

Three Common Errors

- Ignoring fees, which eat into profits over time.

- Following market trends without proper research.

- Failing to establish realistic expectations.

Patience and a disciplined approach go a long way. Remember, successful investors value consistency over hype.

7. Dividend Stocks: Long-Term Value Over Hype

Investing in dividend-paying stocks brings stability to your portfolio. While high-yield options may seem appealing, they often come with increased risks. It’s better to focus on companies with moderate but consistent payouts.

Reinvesting dividends can significantly boost overall returns. Many brokers offer automatic reinvestment programs, which help compound gains effortlessly. This strategy benefits investors who prefer a hands-off approach while building wealth steadily.

8. How to Build a Balanced Portfolio

Creating a balanced portfolio involves selecting assets that align with your risk tolerance and financial goals. Younger investors may lean towards growth-oriented stocks, while those nearing retirement often prefer safer options like bonds or dividend stocks.

Steps to Build a Portfolio

- Assess Risk Tolerance: Decide how much risk you are willing to take.

- Set Goals: Define short-term and long-term objectives.

- Choose Investments: Diversify across multiple asset classes.

- Review Periodically: Adjust allocations as your priorities change.

A well-structured portfolio evolves over time. Staying flexible ensures that your investments remain aligned with market conditions and personal goals.

9. Exploring Sector-Specific Opportunities

Certain sectors consistently provide better returns for investors focused on income. Technology and utilities often stand out due to their strong performance and predictable growth patterns. Energy and healthcare also offer opportunities, particularly during periods of economic recovery.

Sector-based strategies allow investors to target industries with specific growth potential. This approach provides an edge when trying to maximize returns without excessive risk.

10. How Macroeconomic Trends Impact Investment Success

Macroeconomic conditions influence every aspect of investing. Rising interest rates, for example, can reduce the appeal of certain equities, while inflation boosts commodity investments. Investors who understand these trends can anticipate changes and adjust their portfolios accordingly.

Successful investors monitor global trends and adapt quickly. Keeping an eye on macroeconomic indicators ensures that your strategy remains effective, no matter the market conditions.

Conclusion

Starting your investment journey involves more than buying shares. By focusing on income-generating opportunities, monitoring economic indicators, and using the right tools, you can build a strategy that leads to sustainable success.

Risk management and diversification keep your portfolio resilient, while reinvesting dividends maximizes long-term gains.

Begin with small, calculated steps, and don’t hesitate to explore resources that simplify decision-making. Consistency and discipline pave the way for financial freedom.