Choosing a payment solution for your business is like choosing a chair to sit in: it’s all about finding the one that’s least uncomfortable.

With so many options available, it’s easy to get bogged down in the details and end up with a solution that’s just good enough. You should also check out some modern solutions, like the one where you can just tap to pay with phone.

This article will explore the middle-of-the-road payment solutions that are neither terrible nor exceptional because sometimes, mediocrity is all you need.

PayPal ─ The Old Reliable

Pros

- Ubiquity ─ PayPal is everywhere. It’s a household name and trusted by millions of users globally. If you need a payment solution that works almost anywhere, PayPal is a solid, if uninspiring, choice.

- Ease of use ─ Setting up PayPal is a breeze. Both businesses and customers find it intuitive, which means fewer headaches for everyone involved.

- Security ─ With robust security features and buyer protection, PayPal ensures that transactions are relatively safe from fraud.

Cons

- High fees ─ PayPal’s fees are on the higher end of the spectrum. For small businesses, these costs can add up quickly.

- Account freezes ─ PayPal’s risk assessment algorithms can be overly cautious, sometimes freezing accounts without notice, which can disrupt your cash flow.

- Basic customization ─ If you want to personalize your checkout process, PayPal offers limited options.

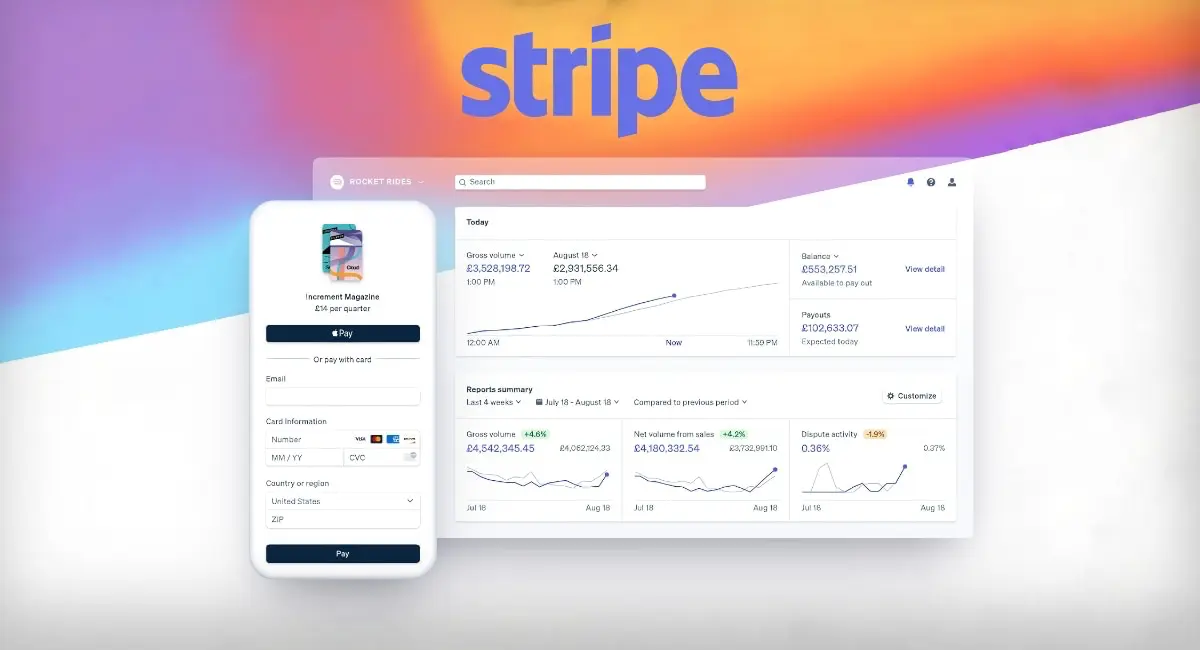

Stripe ─ The Developer’s Delight

Pros

- Customizability ─ Stripe is incredibly flexible, with a powerful API that allows developers to tailor the payment process to their specific needs.

- Transparent pricing ─ Stripe’s pricing is clear and competitive, with no hidden fees. You know exactly what you’re paying for.

- International reach ─ Stripe supports payments in numerous currencies and offers localized experiences, making it a good choice for businesses with international clients.

Cons

- Complex setup ─ The flip side of Stripe’s customizability is that it can be complex to set up. If you’re not tech-savvy, you might need a developer to get everything working.

- Customer support ─ Some users report that Stripe’s customer service can be slow and not particularly helpful.

- Account stability ─ Like PayPal, Stripe occasionally freezes accounts for security reviews, which can be frustrating.

Square ─ The All-In-One Option

Pros

- Comprehensive tools ─ Square offers an array of tools, including payment processing, POS systems, and business management software, all designed to work together seamlessly.

- User-friendly ─ Square’s products are designed for ease of use, making it simple for businesses to get up and running quickly.

- Flat-rate fees ─ Square’s flat-rate fee structure is straightforward and easy to understand, with no monthly fees for basic services.

Cons

- Limited availability ─ Square is primarily available in the U.S., Canada, Australia, Japan, and the U.K., which limits its use for international businesses.

- Support issues ─ Some users have found Square’s customer support to be lacking, particularly when dealing with account issues.

- Advanced features ─ While Square’s basic offerings are robust, some advanced features require additional subscriptions.

Shopify Payments ─ The E-Commerce Companion

Pros

- Seamless Shopify integration ─ If you’re using Shopify for your online store, Shopify Payments integrates perfectly, simplifying your payment processing.

- No extra fees ─ Using Shopify Payments means you avoid the additional transaction fees that Shopify charges for other payment gateways.

- Ease of management ─ Managing payments and your online store in one place can save time and reduce complexity.

Cons

- Geographic limitations ─ Shopify Payments isn’t available in all countries, which can be a significant drawback for some businesses.

- Shopify dependency ─ If you’re not using Shopify for your store, you can’t use Shopify Payments, limiting its appeal.

- Extra costs for alternatives ─ If you opt for a different payment gateway, Shopify will charge you additional transaction fees, which can eat into your profits.

Conclusion

Choosing a payment solution is a crucial decision for any business, but it doesn’t have to be a quest for perfection.

Each of the options discussed—PayPal, Stripe, Square, and Shopify Payments—offers a balanced mix of pros and cons that can meet the needs of many businesses.