At the point when you become an entrepreneur, you will undoubtedly commit a couple of errors and mistakes. You know, sometimes mistakes can cost you a little more than you expected. Nobody intentionally makes mistakes, but you must keep certain things in your mind to ensure you don’t repeat them.

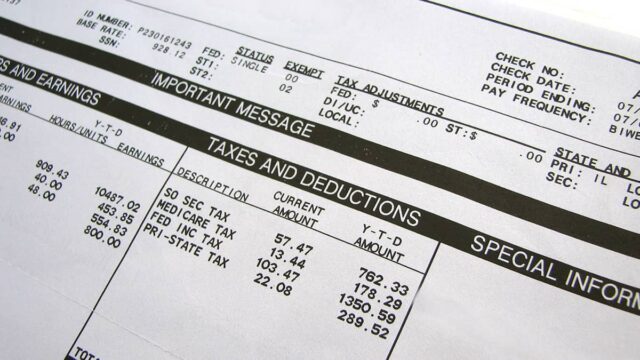

A pay stub is one of the most important financial documents for you and your employees, requiring proper management and administration. A pay stub is a piece of the work that rundowns the employee’s compensation data. It shows the wages acquired during the payroll interval and year-to-date finance. It likewise shows charges that are taken out and some other allowances. Sometimes while creating the pay stubs for your employees, you might make certain mistakes in maintains the pay stubs and further in the article, we will talk about all the errors and mistakes you must avoid.

Some Of The Mistakes To Avoid When Creating Pay Stubs For Your Employees:

Let’s check out all those errors and mistakes that are generally made by different businessmen. If you want to protect yourself from that, you need to know that earlier so that you will be able to prevent yourself from repeating those errors.

1. Improper Tax Data:

This is one of the most general mistakes made by different entrepreneurs because the government and state charge regulations continually, and your pay stub should incorporate portions in light of current tax regulations. If your data are not updated according to the new tax regulations, then the whole record of the earnings will be disturbed.

In the event that the savings are not right, the specialist might have a startling expense obligation toward the year’s end and conceivably owe punishments for underpayment of charges. This can be a real fault and can cause big trouble. You will make up the difference when you calculate and pay the wrong tax rate. In the future, this will cause a lot of trouble, so be attentive and know everything about the federal tax regulations that are currently followed in your region.

2. Missing Payroll-related Deadlines:

With regards to payroll finance, you assume the job of being a deadline tracker. At the last moment, it can be really troublesome for you to keep track of everything. On the off chance that you don’t follow due dates for the payrolls and do not have a track of the income tax-related guidelines, you might face a lot of issues. You could end up in deep water with your employees and the public authority or thegovernment, and nobody wants to face these issues. This is why it is highly recommended to use the best pay stub generator to make your work far easier. If you have a good paystub generator, you will be able to give priority to the core activities. Legal pay stubs are an important thing for the smooth functioning of your organization.

If you are looking for one such legal pay stub generator, then you can check out some of the reliable sources that can help you out in creating your own reliable paystubs for your employees. To guarantee you generally pay your workers on time and record and dispatch your duties by their due dates, you can ensure you are coordinated, which can be done only by having an organized pay stub.

3. Miscalculating The Employee’s Income:

Many times it physically becomes hard for you to note all the details related to the income of the employees. Many times the employees leave in the middle and maybe work for some extra hours, which can cause a fluctuation in the pay rates.

These are usually the mistakes that different employers make. In the future, because of some miscalculation of the employee’s income, you can face many issues, and whole financing management can be disturbed severely. Many new businessmen do not have much idea about how important it is to have proper management of pay stubs. To ensure this mistake does not happen, you must double-check the pay rates, calculate the overtime pay perfectly, and use a proper paystub software that ensures no miscalculation.

4. Not Classifying The Workers Properly:

This mistake is not always the usual one, but it might occur if you do not follow a certain step from the start. There are usually two types of workers in an organization, and the pay rates depend upon the classification of the employees. If you don’t have enough idea about the classification, then you need to know that you can classify the employees in two ways, one is exempt, and another one is nonexempt.

Now the question is, what is the difference between both of them. The major difference is you don’t pay overtime wages to the exempt workers. They are not paid for it. As there are certain laws that are followed while paying the employees, the federal laws say that you only have to pay the nonexempt workers for the overtime work, usually when they work for more than 40 hours. This is the latest regulation, but you must have a record of everything so that you can form the pay stub appropriately.

5. Not Investing In The Right Tools:

Other than all the factors related to the miscalculation, it is highly important to invest in the right tools; sometimes, you might be doing the right calculation, but the software or the tools you are using are not working up to their mark. The best tools and software plays a huge role in the administration and management of paystubs. Always make sure to use the best softwares so that you can be able to manage all your employees payroll perfectly and without any faults.

If you are a new employer, it is an essential factor you must keep in mind. If the base is strong, you will have a proper administration and working environment in your organization.

The Takeaway

The article contains some of the general mistakes made by employers. To protect yourself from making any of these errors, you must use the right measures and be attentive while recording every piece of information.